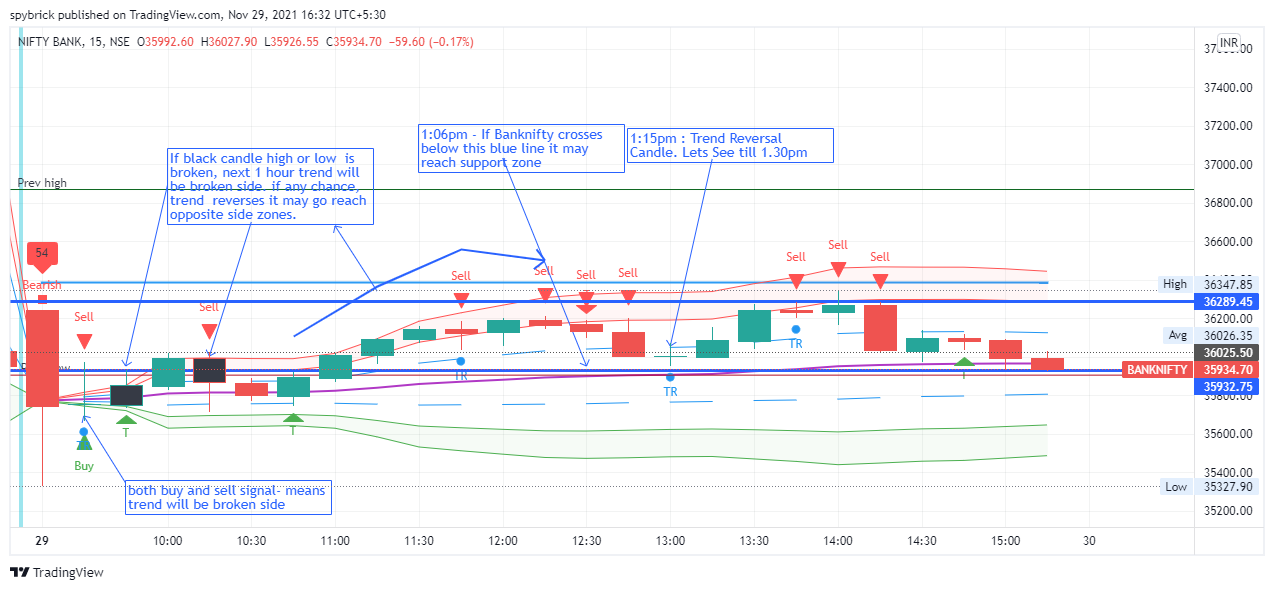

Indicator 15min

SpyBrick Indicator Documentation

How to use

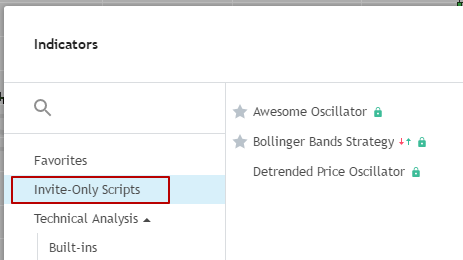

Once you get access, you can see our indicator in the invite-only Scripts Tab. You can apply this indicator on Options, Futures and Nifty 50 Stocks.

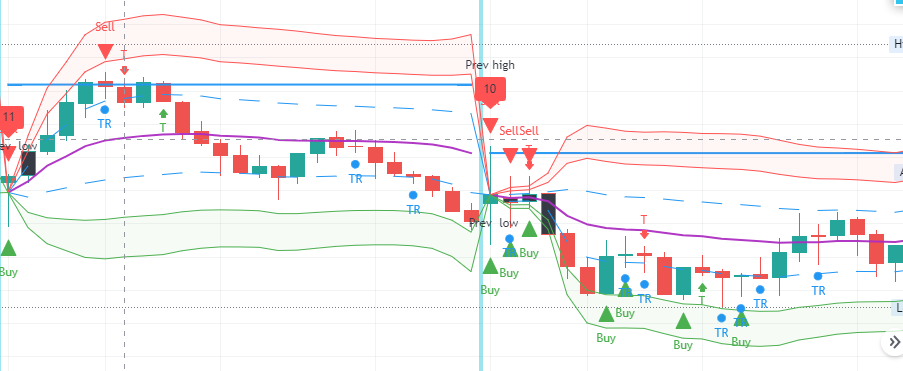

When you click on the spybrick indicator, you will see signals as below. Let us understand signals one by one.

Please note this indicator works only in 15 min timeframe and Timezone should be utc+5:30

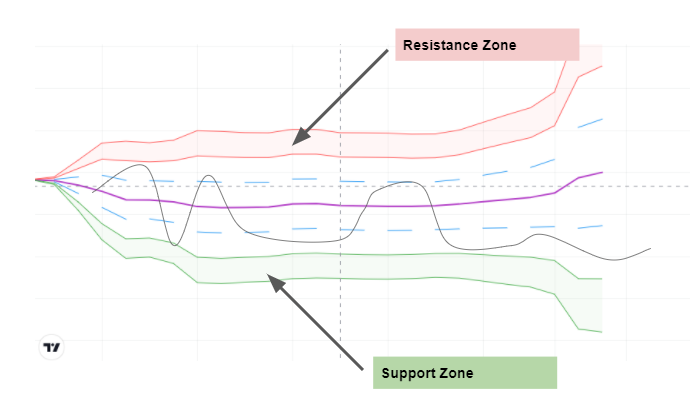

Structure

Basic structure consists of a Support and Resistance zone. Candles never come out of these zones ( except the first four candles of a session ). If any candles body comes out of these zones, expect a reverse trend or sideways trend on that day.

candle's body out of zones in hdfc on 12th Nov 2021.

Different types of Signals

Our Indicator gives different types of signals. From these signals you can get an idea when to take trades, trend reversals and trend continuation ideas. Following are the signals...

- Buy and Sell Signals

- First Candle Signals

- Strong Buy and Sell Signals

- Black Candles

- CR Signal

- T and TR Signal

Buy and Sell Signals

Please follow rules before taking any trades. Don't take trade blindly and lose money. You should observe these signals in realtime not just in backtesting.

You should wait till full candle formation even if you get any buy or sell signal at the starting of the candle.

You should also control your emotions and understand signals and targets given by our indicator. We Recommend you to do realtime proper paper testing on neostox.com before investing your money on trading.

You don't need to hit home runs to win the investing game. Focus on getting base hits. To grow your portfolio substantially, take most gains in the 20 -30 points range in Nifty and 50 -80 points range in Banknifty.

Newbies and Safe traders always book your profits in Nifty with 20-30 points range and bank nifty 50-80 points range. In option Buying, Sometimes, The more you stay the more you lose your profits due to theta and time decay.

Let us dive into understanding signals

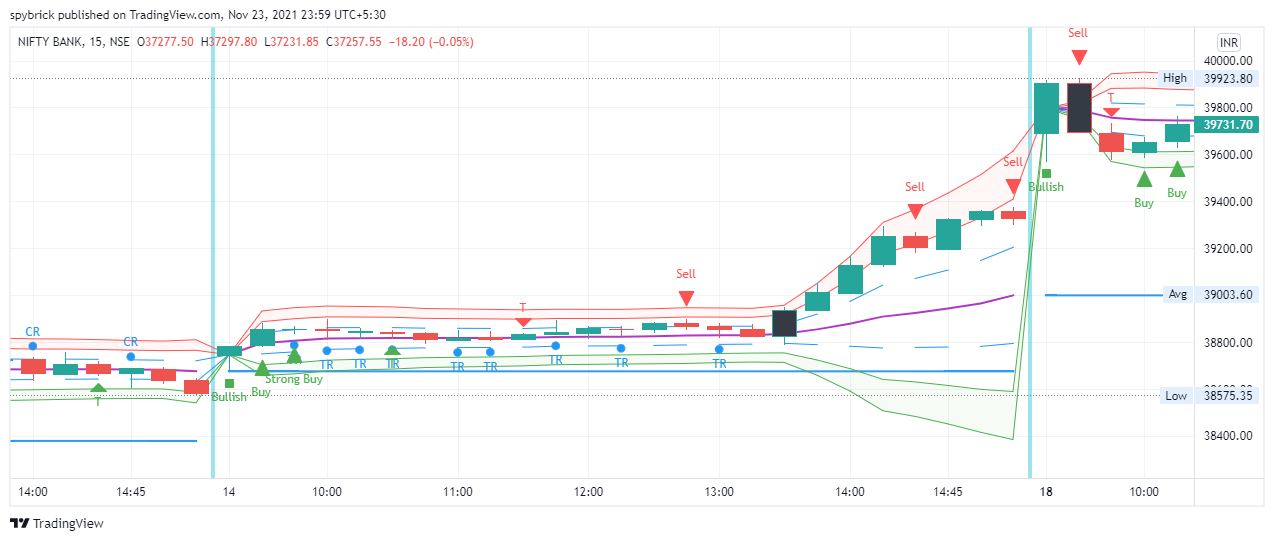

If the first candle closes below the previous day trend line ( blue line) then we look for "sell" signals. Take buy side only when the high of black candle is broken otherwise don't take any buy trades on that day.

If the "Low" of the "sell" signal candle is broken ( for banknifty, use buffer 10-20points, 20 is better), Take sell side ( PE Buying ) entries. First target is the purple line and the second target is the blue dotted line and the third target is the support zone. If the candle is far from the support zone, Stop loss is in the middle of the support zone, otherwise the last support line. Please note Targets are dynamic values.

Note: We don't get profits everytime. sometimes we may hit stop losses. Based on our testing,

- 90% trades reach target one

- 60% trades reach target two

- 30% trades reach target three

For example : 17th Nov,2021 Banknifty 15min timeframe chart, all targets reached.

If the first candle closes above the previous day trend line ( blue line) then we look for buying signals. Take the sell side (PE Buying) only when black candle "low" is broken Otherwise Take entry only the buy side. Example: Buy signal and targets on Banknifty 12th Nov,2021

There are few rules taking trades using black candle. Please read carefully about black candles below.

First Candle Signals

Sometimes Indicator may give bearish and bullish signal on first candle with percentage of body on it.

If Session's first candle ( total candle) is below prev trend line( blue line) and body percentage is more than 60%, then take "Sell" trade ( PE Buying) below "low" of first candle. 1st target is half of the first candle body and Stop loss is high of the first candle. Trail till the candles reach support zone or wait till buy signal

Bearish becomes strong bearish if first candle also breaks "low" of prev day

If Session's first candle ( Total candle) is above prev trend line ( blue line) and body percentage is more than 60%, then take "Buy" trade ( CE Buying) above "High" of first candle. 1st target is half of the first candle body and Stop loss is low of the first candle.

Bullish becomes strong Bullish if first candle also breaks "High" of prev day

Note: You need to be careful with inside candles. If any inside candles are formed after taking trades, Trend may reverse or go in our favor. Have strict stop loss or trail the stop loss.

This may fail if first candle is more than 400 points in Banknifty. You need to know the average size of day candles in stocks and options. If first candle is more than average size of day candles, you should trade keeping lower targets than half of the first candles body.

Strong Buy and Strong Sell Signals

After 9.45 the indicator may strong buy and strong sell signal.

Strong Buy:- Take an entry when the highest of three candles is broken. example : 11Oct2021 - BankNifty - 15min

example: 14th Oct 2021

Strong Sell: - Take an entry when the lowest of first three candles is broken.

Strong Sell: - Take an entry when the lowest of first three candles is broken.

example: 16th Nov 2021

Black Candles

These Candles gives info about next 1 hour trend.

If the "High" of black candle is broken off the body of the candle, Take an entry from "close" of the candle. Trail till the candles reach the resistance zone or till indicator gives a "Sell" signal. Stop loss is low of the black candle.

Normally, if black candle "high" or "low" is broken, the next one hour trend will be on the broken side. If it reverses and crosses high or low of black candles, expect candles to touch the opposite side zone. Example: BankNifty 08Nov2021.

example: BankNifty 29Nov2021.

CR Signals

When the indicator give this signal, expect the present trend ( prev 5 candles) is going to stop within the next 5 candles. Either trend goes in the opposite direction (Reversal) or go in sideways. Also sometimes expect big momentum candles which take stop losses on either side ( CE and PE).

for example : axis bank on 09Nov021

BankNifty on 10Nov021

Trend and Trend Reversal Signals

"T" signal gives the direction of the next candle and this is called the "Ten rupees" candle in BankNifty. Whenever the indicator give this signal, take trades high or low side of this candle and exit when you get ten rupees profit that means 250 rupees per lot in bank nifty.

"TR" means Trend Reversal signal. Trend may reverse after "TR" signal.

Multiple Signals

- "T" signal followed by "Buy" or "Sell" - strong signal

- "TR" and "CR" signal - May be Trend Coninutation

- "T" and "TR" - Wait for confirmation.

- "Buy" and "TR" - Wait for Confirmation.

- "Sell" and "TR" - Wait for confirmation.

- "Sell" and "Buy" - Next 1 hr Trend will be breakout side

2

SMART INDICATORS

30+

INSTRUCTOR VIDEOS

250+

HAPPY USERS

72%

SUCCESS RATE

72% Sucess rate

in BankNifty and Nifty

High Probability of

Winning Trades

Not only BUY and SELL Signals, this indicator also gives trend continuation, trend reversal, bullish, bearish and our favorite logic "CR" candles.

Download For Free

Subscrible now

Get every single

update you will get

Community

More

Disclaimer: I am NOT a SEBI registered advisor. I'm in No way responsible for your Profit or Loss, Options trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to trade in markets. Please understand the risks before taking any trades.

All rights Reserved © SpyBrick, 2021